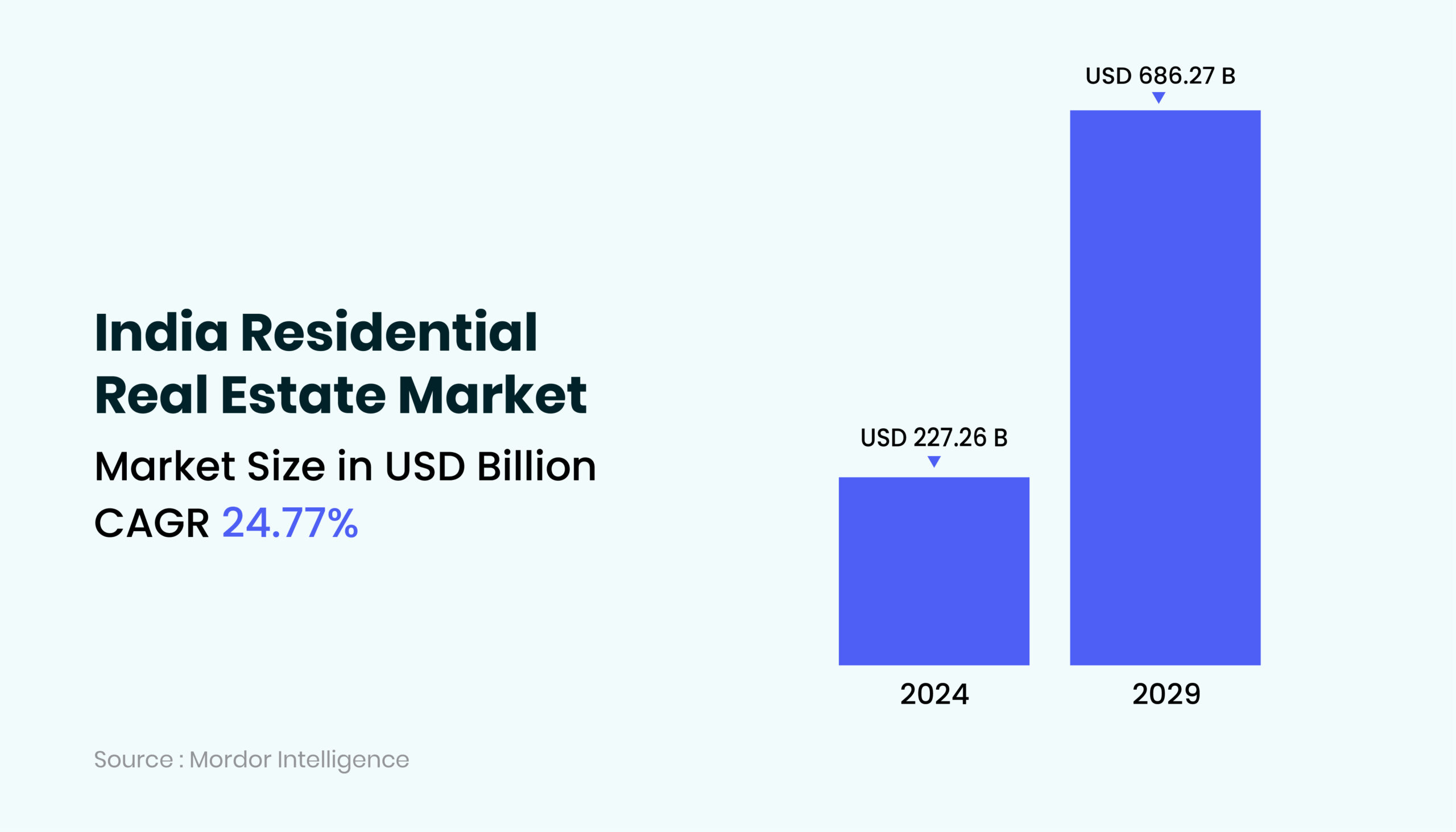

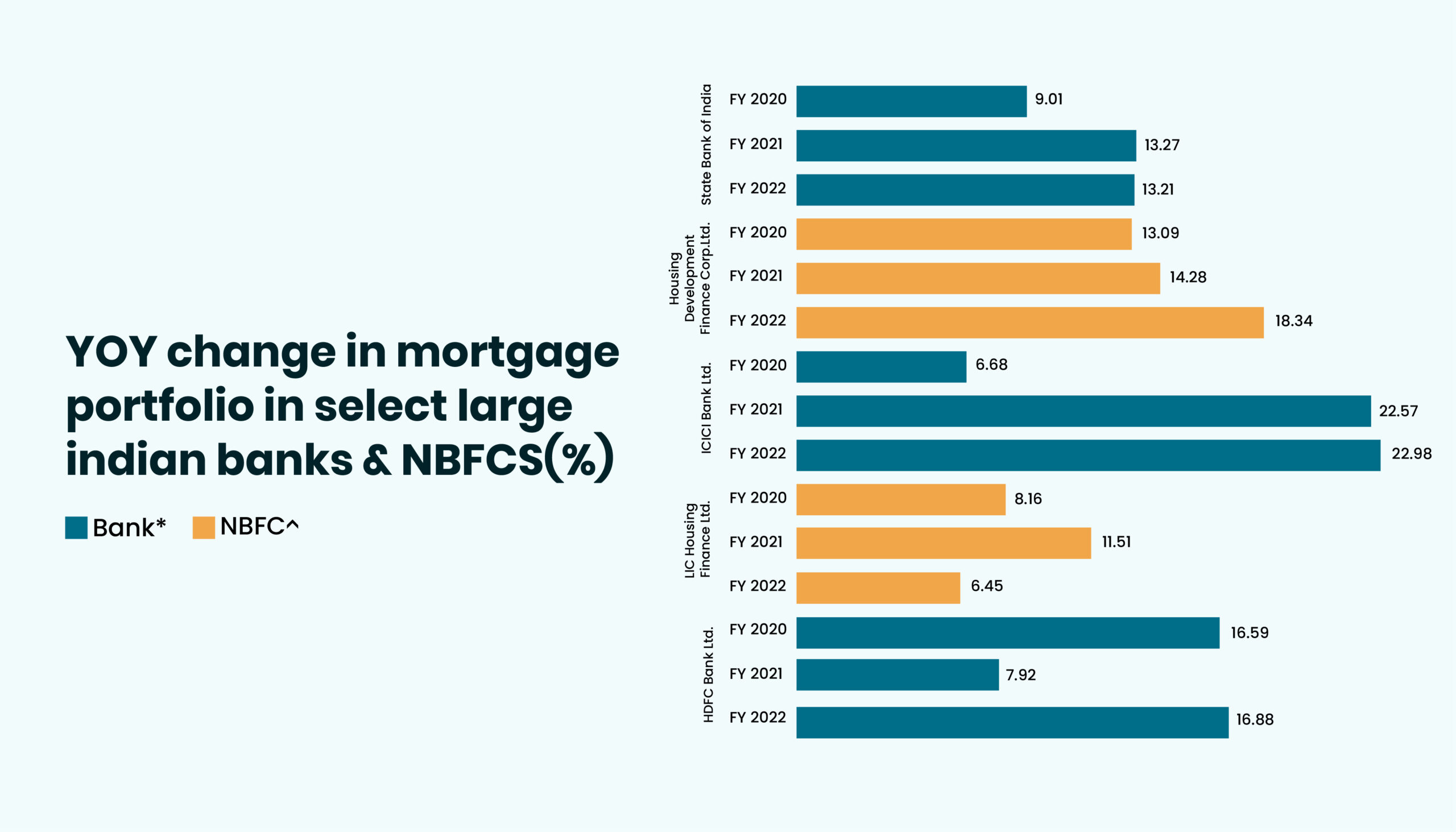

Housing finance in India has undergone a transformative journey, driven by increasing aspirations, urbanization, and a growing middle class with rising incomes. Unlike in many Western countries, homeownership in India is deeply personal—an asset to live in and use, rather than an investment to pass down or speculate upon. The notion of an Indian housing bubble is often exaggerated. For 99% of Indians, generational wealth isn’t inherited; instead, people seek homes for immediate utility. This fundamental difference sets India apart from markets like the US, where housing often serves as an investment vehicle. While India’s per capita income and GDP remain behind those of developed nations, the steady rise in household incomes and some of the lowest housing loan interest rates globally continue to push demand for housing.

Yet, despite the growing demand and the ongoing housing price boom, the success of a housing finance company depends on much more than having the right product or offering competitive rates. Imagine this scenario: your housing finance company has an impressive product portfolio, one of the lowest interest rates in the market, and a comprehensive marketing strategy. Everything looks perfect on paper. But month after month, sales targets are missed, customer complaints rise, and market share slips. What’s the problem?

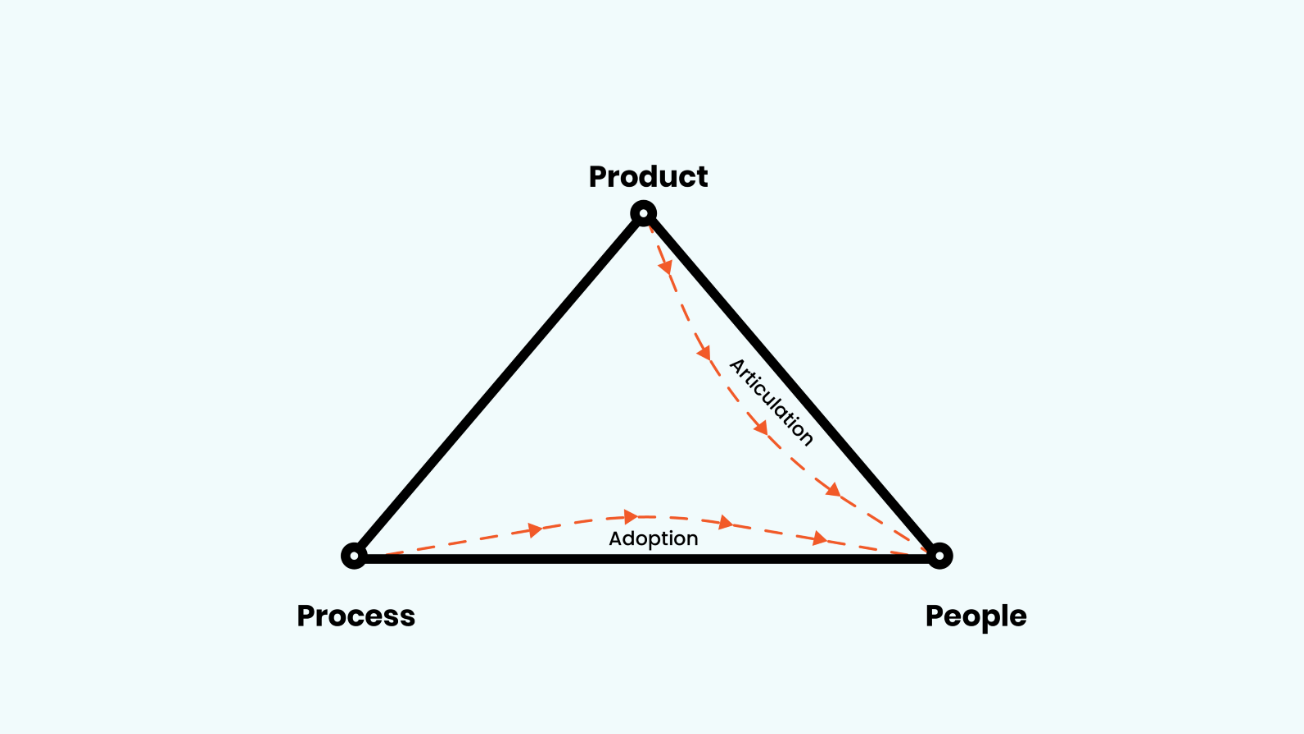

In the highly competitive housing finance market, often called a red ocean market, product is no longer the key differentiator, as most institutions offer similar solutions. Instead, the real edge comes from the triad of people, process, and product, where the sales team plays a crucial role. While processes ensure efficiency and compliance, they are heavily dependent on the people who implement them. Sales teams are not only the face of the company, building trust and relationships with clients, but they also ensure that these processes run smoothly. In this way, it’s the people, especially in sales, who drive differentiation in a market where products alone can’t.

The culprit is clear—your product is not the differentiator; the effectiveness of your sales team is. A sales force that isn’t fully prepared to navigate the complexities of the housing finance industry can severely impact performance. While your products and strategies are critical, they won’t translate into success without a team capable of understanding customer needs, simplifying complex regulations, and closing deals effectively.

In the highly competitive world of housing finance, where customers are often making the biggest financial decision of their lives, it’s not just about what you sell—it’s about how you sell. A robust, well-trained sales team is the linchpin of a housing finance company’s success. Their ability to manage diverse customer profiles, adapt to evolving regulations, and guide buyers through the intricate loan process directly impacts your bottom line.

Expertise in Housing Finance: The Foundation of Sales Success

In any industry, having a sales team that is well-versed in the specific knowledge and intricacies of their market is crucial. Expertise goes beyond product knowledge; it includes understanding industry trends, regulatory requirements, and customer pain points. When sales professionals are equipped with this in-depth understanding, they are better positioned to build trust with clients and guide them through the decision-making process.

Understanding the intricacies of the housing finance industry is vital for any sales team. A lack of expertise can lead to lost opportunities and diminished customer trust. According to a report by PwC, 67% of homebuyers prioritize working with financial institutions that demonstrate in-depth knowledge of mortgage products and the lending process.

Example: Consider FinHome Solutions, a growing housing finance company that recently revamped its sales training program. At the Business Development Executive level, professionals are expected to have a foundational understanding of the housing finance industry, including operational excellence in lending and a solid grasp of home loan products. This ensures they can effectively guide potential clients through complex mortgage options, eligibility criteria, and interest rate considerations.

As these professionals progress to the Senior Business Development Executive level at FinHome Solutions, their industry knowledge deepens. They gain an intermediate understanding of not just lending practices but also compliance and key regulations. This advancement is crucial in ensuring that senior executives provide clients with the most current and tailored financial solutions, significantly enhancing customer satisfaction and loyalty.

Effective Communication and Negotiation: Key to Closing Deals

In sales, communication is more than just conveying information; it’s about creating a connection, addressing concerns, and guiding clients toward a decision. The ability to communicate effectively and negotiate successfully is critical across industries, as it directly impacts client relationships and the likelihood of closing deals. Sales teams that excel in these areas tend to achieve higher customer satisfaction and stronger sales performance.

Effective communication is a cornerstone of successful sales in housing finance. Clear, responsive communication can significantly impact client decisions. A study by JD Power found that 93% of mortgage customers value timely and clear communication throughout the loan process, which directly correlates with higher satisfaction scores.

Example: HomeFin Services, another emerging player in the housing finance sector, recognized the importance of communication and negotiation early on. At the beginner level, Business Development Executives at HomeFin are trained to handle objections and negotiate with a problem-solving approach, ensuring they can address client concerns and close deals efficiently. As they advance to senior roles, their negotiation skills become more strategic, allowing them to secure deals that align with both client needs and company objectives.

For HomeFin, investing in these communication and negotiation skills has led to smoother transactions, higher client retention, and ultimately, greater financial performance.

Strategic Planning and Data-Driven Decision Making: The Competitive Edge

Across all industries, strategic planning and the use of data-driven insights are fundamental to achieving a competitive edge. Companies that leverage data to guide their sales strategies are better equipped to identify opportunities, optimize processes, and anticipate market changes. This approach not only drives better outcomes but also positions the organization as a leader in its field.

In today’s data-driven world, strategic planning and leveraging data are critical for staying ahead in the competitive housing finance market. Companies that use data to inform their sales strategies are significantly more successful. According to McKinsey & Company, data-driven organizations are 23 times more likely to acquire customers and six times more likely to retain them.

Example: At FinHome Solutions, Senior Business Development Executives play a pivotal role in utilizing data to drive sales strategies. Competencies like Lead Management Strategy and Data-Backed Decision Making for Sales are crucial at this level. These executives harness data to identify promising leads and refine their sales approaches, tailoring solutions to meet specific client needs. This strategic use of data not only enhances sales performance but also strengthens the company’s competitive position.

Moreover, the emphasis on Sales Performance Optimization in senior roles ensures that the sales team continually improves, learning from data insights, and replicating success across the board, thereby driving overall business growth.

Team Collaboration and Synergy: Driving Organizational Success

In any business, teamwork and collaboration are key drivers of success. When sales teams work together and align with other departments, they create a unified approach to achieving company goals. This collaborative spirit leads to enhanced efficiency, better client experiences, and, ultimately, superior business outcomes.

Collaboration within a sales team and across departments is essential for delivering a seamless client experience. Companies with strong team collaboration are five times more likely to be high-performing, according to a study by the Institute for Corporate Productivity.

Example: At HomeFin Services, Business Development Executives start by aligning with organizational values and working effectively within their teams. As they progress to senior roles, they take on leadership responsibilities, driving collaboration across different departments to ensure every client interaction is smooth and efficient.

This focus on Synergistic Team Collaboration not only improves internal processes but also enhances the client experience, leading to higher satisfaction rates and more repeat business.

Continuous Learning: Adapting to Industry Changes

In every industry, continuous learning and professional development are vital for staying ahead of the curve. As markets evolve and new technologies emerge, a commitment to ongoing education ensures that sales teams are equipped to adapt to changes and seize new opportunities. This proactive approach is crucial for maintaining a competitive edge.

In the dynamic field of housing finance, continuous learning and development are crucial. The industry’s rapid evolution, driven by technological advancements and changing regulations, requires a sales team that is not just reactive but proactive in its approach.

Example: Companies like FinHome Solutions understand the importance of continuous upskilling. By focusing on emerging competencies like GenAI Readiness and Innovation and Creativity, they prepare their sales teams to leverage cutting-edge tools, anticipate market trends, and offer innovative solutions to clients. This approach not only enhances sales performance but also positions the company as a leader in the industry.

Conclusion: Building a Future-Ready Sales Team

In the housing finance industry, a strong sales team is more than just a group of individuals selling products—it’s the driving force behind a company’s success. By investing in the right skills and continuously developing their competencies, companies can ensure that their sales teams not only meet but exceed expectations.

Partnering with training and development providers like AntWalk Pvt. Ltd. can further enhance these efforts, offering tailored programs that prepare sales teams to navigate the complexities of the housing finance market with confidence and competence.